Once you fill your portfolio with your income stock holdings, there are a variety of tools at your disposal.

(If you have not yet populated your portfolio with stocks click here for instructions.)

One of the most powerful tools Divcaster makes available is the “What-If Scenario”.

This tool is 100% unique to Divcaster.

You’ve probably encountered this challenge before…

You find an attractive new income investment that would fit perfectly into your portfolio.

However, without the spare cash to purchase the stock, you’ll need to sell some other holding to fund the purchase.

Well, when you sell that other stock, what happens to your portfolio’s income? Do you know the amount of total income you give up by selling those shares and purchasing your new income investment? Do you know the amount you’ll add?

With Divcaster’s “What-If Scenarios” you can enter in how many shares of the stock you wish to purchase and how many shares of the stock you wish to sell…

Then voila! The change to your portfolio’s income will be plotted on your income forecast chart.

Here’s how it works…

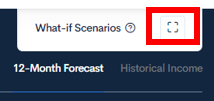

In the top right corner of your portfolio screen you’ll see the “What-If Scenarios” menu.

To open your first What-If scenario, click the “square” in the top right.

Here it is in an image below:

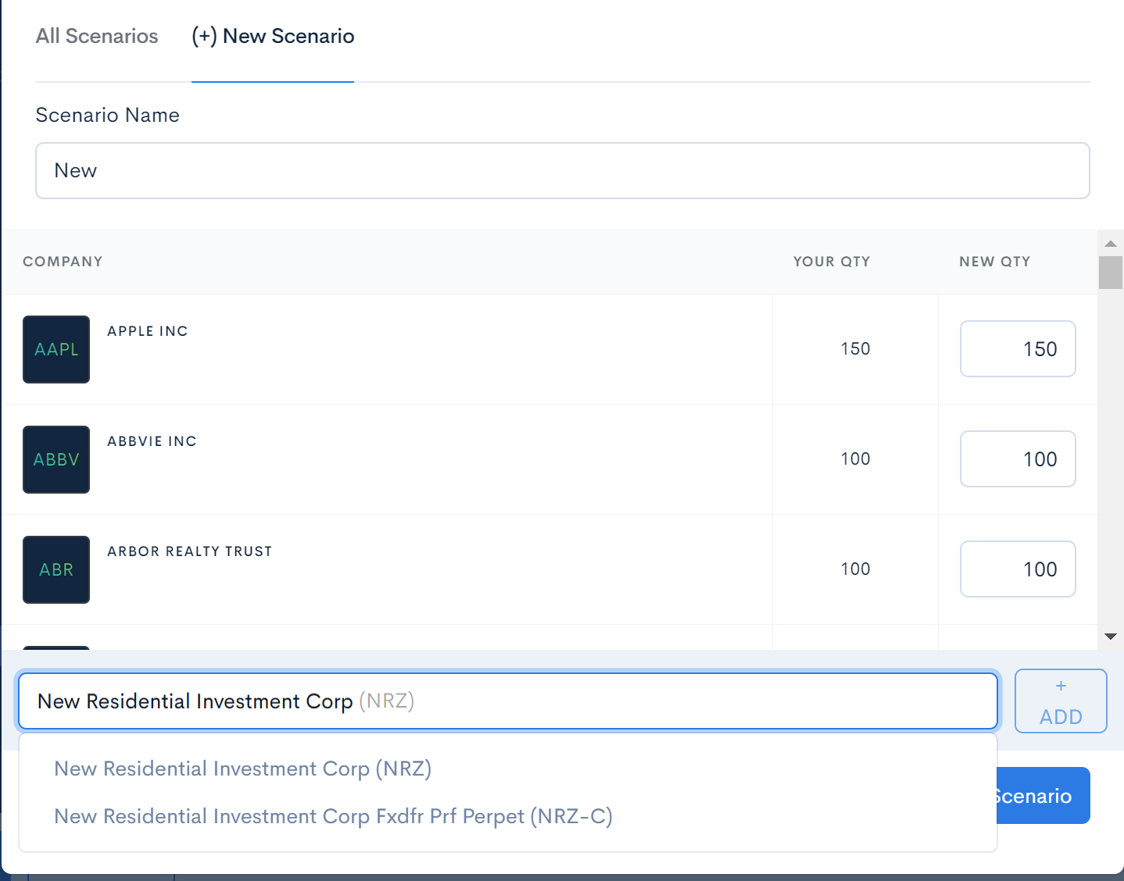

When you click the square above, it will open up the menu to create your first What-If scenario.

To create your first scenario, click the plus sign (+) beside one of the available Plot Scenario links. That will bring up the what-if scenario builder in the middle of your screen.

Inside of the builder you will see your current portfolio with all of your stock holdings for that particular portfolio.

Your first step is to name this new ‘Scenario’. My advice is to name the scenario with what action you’re going to take.

It can be something along the lines of “Buy stock XYZ and sell stock ABC”.

Once you’ve named your portfolio it’s time to add and subtract holdings.

On the right side of the menu you will see two columns titled “Your QTY” and “New QTY”. Your QTY shows how many shares you currently own in your portfolio. New QTY will contain the changes to your portfolio from the what-if scenario.

Inside your ‘What-If’ scenario you can:

- Modify the quantity of existing positions in your portfolio (add or subtract)

- Add a new stock position and quantity

Increase the quantity to plot what happens to your income when purchasing more shares or what happens to your income when you sell shares.

There’s also the opportunity to add a new stock and new quantity.

To plot the income of adding a new stock, search the company name or ticker symbol in the search bar at the bottom of the pop up and select it, then click the “+ ADD” button.

The new stock will appear at the top of the list. Once the stock appears in the list that you wish to add to your scenario, make sure you click the name in the dropdown.

Then the “+ ADD” button will turn blue and you can add that ticker to the portfolio.

Then you can add the quantity you want to buy in the box next to it.

You can add other stocks by repeating the directions above.

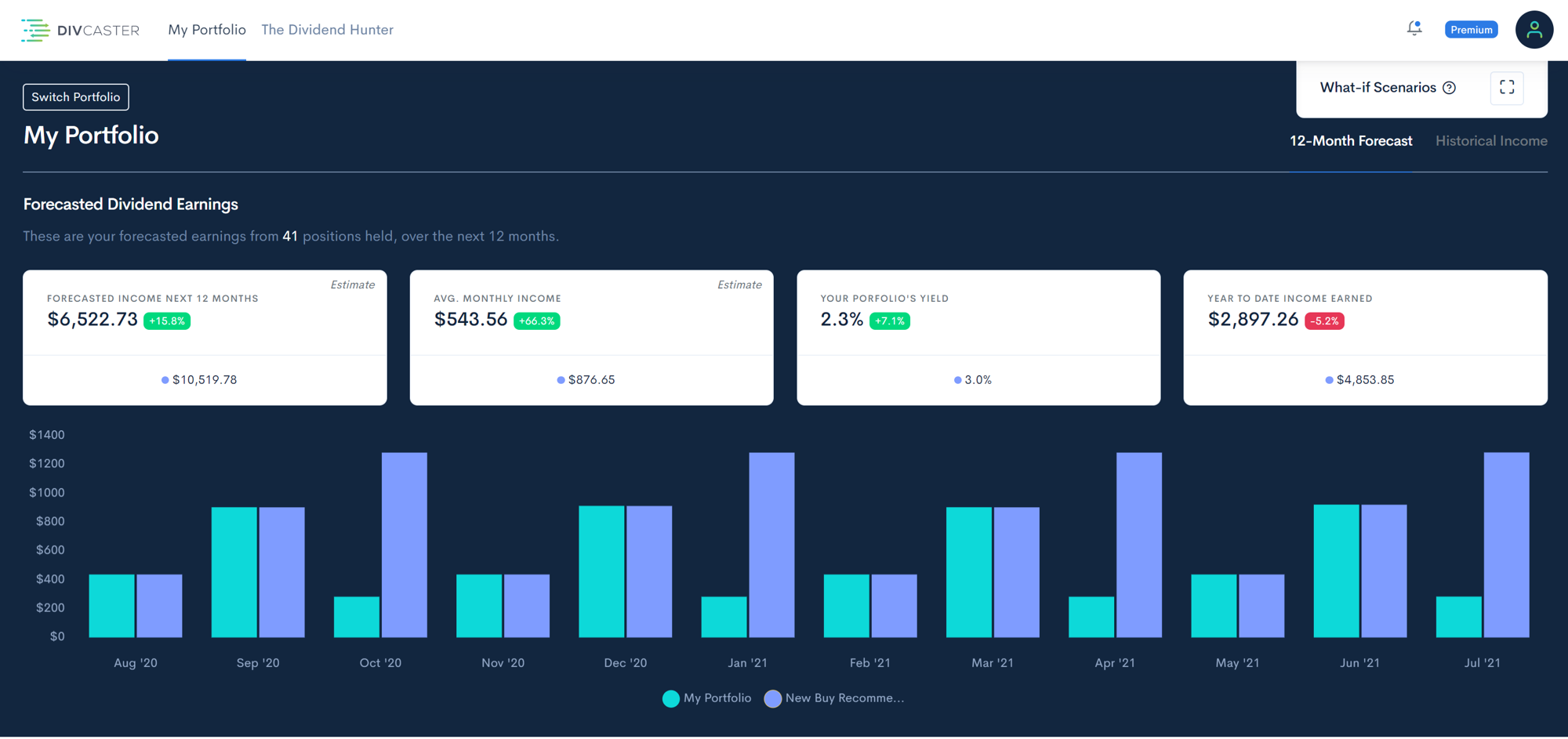

Now your portfolio income forecasting chart will update with your new “What-If Scenario”.

Now you can see plotted on this graph how your income will change if you make those changes to your portfolio!

In the image above you can see that the potential income from this portfolio is mostly the same. Except the forecasted income for October, January, April, and July is much higher.

To watch a detailed tutorial on What-If scenarios, give the video below a watch.